Introduction

In the high-stakes world of precision engineering, the choice between Original Equipment Manufacturer (OEM) and aftermarket parts can make or break operational success. For industries where failure isn’t an option—aerospace, oil & gas, and advanced manufacturing—this decision impacts everything from safety compliance to bottom-line profitability.

At ET&ED, we’ve witnessed firsthand how the right parts procurement strategy can transform operational efficiency. Based in Singapore and serving precision-engineered operations worldwide, our experience with clients across critical industries has revealed key insights into optimizing this crucial decision.

According to Grand View Research, the global aftermarket parts industry reached $218.82 billion in 2023 and is projected to hit $336.79 billion by 2033—a testament to the growing acceptance of aftermarket solutions across industrial sectors.

Understanding the Fundamental Difference

What Are OEM Parts?

OEM (Original Equipment Manufacturer) parts are manufactured by the same company that produced the original equipment or by authorized suppliers using identical specifications, materials, and quality control processes. These components maintain exact compatibility with existing systems and carry the manufacturer’s warranty and certification.

What Are Aftermarket Parts?

Aftermarket parts are manufactured by third-party companies and designed to function as direct replacements for OEM components. While they must meet basic compatibility requirements, they may vary in materials, manufacturing processes, and quality standards compared to original specifications.

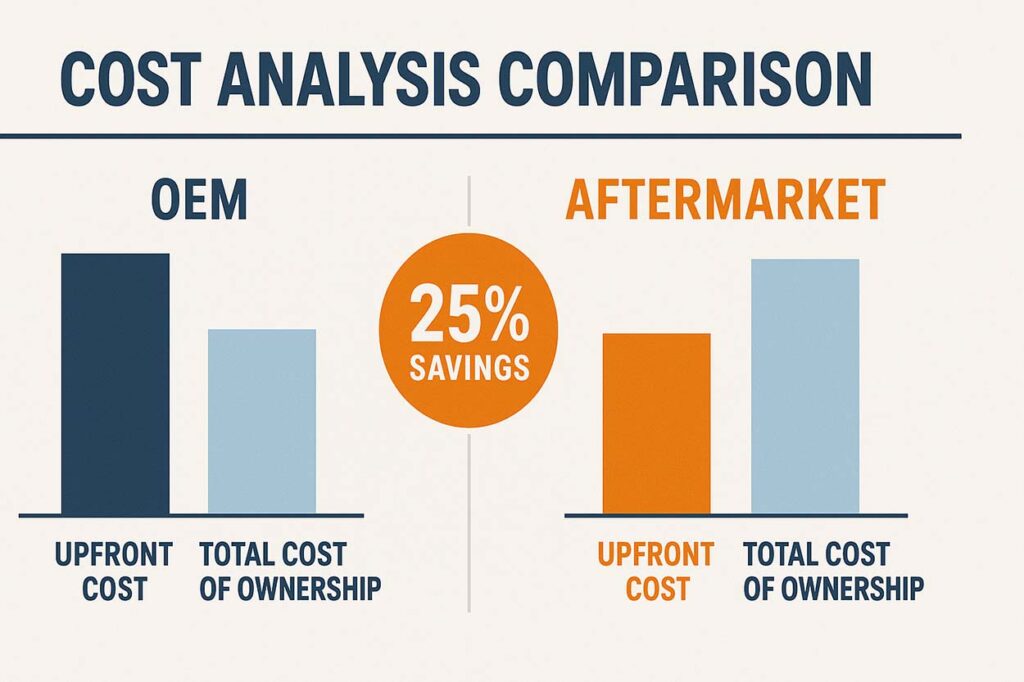

Comprehensive Cost Analysis Framework

Initial Investment Comparison

OEM Parts Pricing Structure: – 40-60% higher upfront costs compared to aftermarket alternatives – Premium pricing reflects guaranteed compatibility and certification – Bundle pricing often available for complete system overhauls – Predictable pricing with established supply chains

Aftermarket Parts Pricing Structure: – 25-50% cost savings on initial purchase – Wider price range depending on manufacturer reputation – Volume discounts more readily available – Price volatility due to market competition

Total Cost of Ownership (TCO) Analysis

The true cost extends far beyond initial purchase price:

Hidden Costs to Consider: – Installation and integration time – Downtime during replacement – Training requirements for maintenance teams – Inventory management complexity – Insurance and liability implications – Regulatory compliance costs

Long-term Financial Impact: Research from industrial operations shows that while aftermarket parts may save 30-50% upfront, total operational costs over 5 years can vary significantly based on application criticality and quality selection.

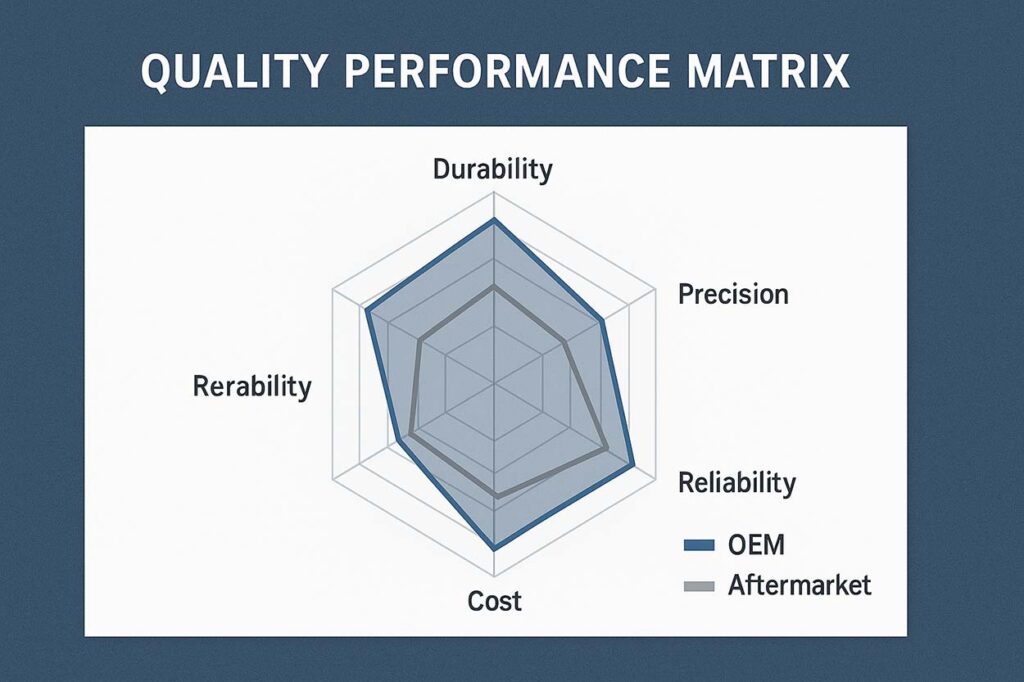

Quality Performance Matrix

OEM Quality Standards

Manufacturing Consistency: – Identical materials to original specifications – Same production facilities and quality control – Consistent performance across all units – Predictable failure patterns and maintenance schedules

Certification and Compliance: – Full regulatory compliance guaranteed – Industry-specific certifications (AS9100, API, ISO standards) – Traceability documentation included – Warranty protection maintained

Aftermarket Quality Spectrum

Premium Aftermarket Suppliers: – May exceed OEM specifications – Advanced materials and improved designs – Rigorous testing and certification processes – Comparable or superior performance metrics

Standard Aftermarket Options: – Meet basic functional requirements – Variable quality control processes – Limited certification documentation – Cost-focused manufacturing approaches

Budget Aftermarket Alternatives: – Minimal quality assurance – Potential performance compromises – Limited warranty coverage – Higher failure risk factors

Industry-Specific Applications

Aerospace Sector Requirements

Critical Considerations: – FAA and EASA certification requirements – Zero-defect operational standards – Comprehensive traceability documentation – Extended service life requirements

OEM vs Aftermarket in Aerospace: – OEM parts mandatory for flight-critical components – PMA (Parts Manufacturing Approval) aftermarket options available – Significant cost savings possible for non-critical applications – Rigorous supplier qualification processes required

Case Study: A major aerospace manufacturer reduced maintenance costs by 23% while maintaining 100% safety compliance by strategically implementing certified aftermarket parts for non-flight-critical systems.

Oil & Gas Operations

Environmental Challenges: – Extreme temperature variations (-40°C to +150°C) – Corrosive chemical exposure – High-pressure operational conditions – Remote location serviceability requirements

Parts Selection Criteria: – API certification requirements – Extended mean time between failures (MTBF) – Chemical compatibility specifications – Emergency replacement availability

Real-World Impact: An offshore drilling operation achieved 15% reduction in unplanned maintenance by implementing a hybrid procurement strategy combining OEM critical components with premium aftermarket alternatives for auxiliary systems.

Advanced Manufacturing

Precision Requirements: – Tight tolerance maintenance (+/- 0.001mm) – Consistent performance repeatability – Integration with automation systems – Minimal production disruption during replacement

Strategic Considerations: – Production line compatibility – Supplier reliability and delivery schedules – Technical support availability – Obsolescence management planning

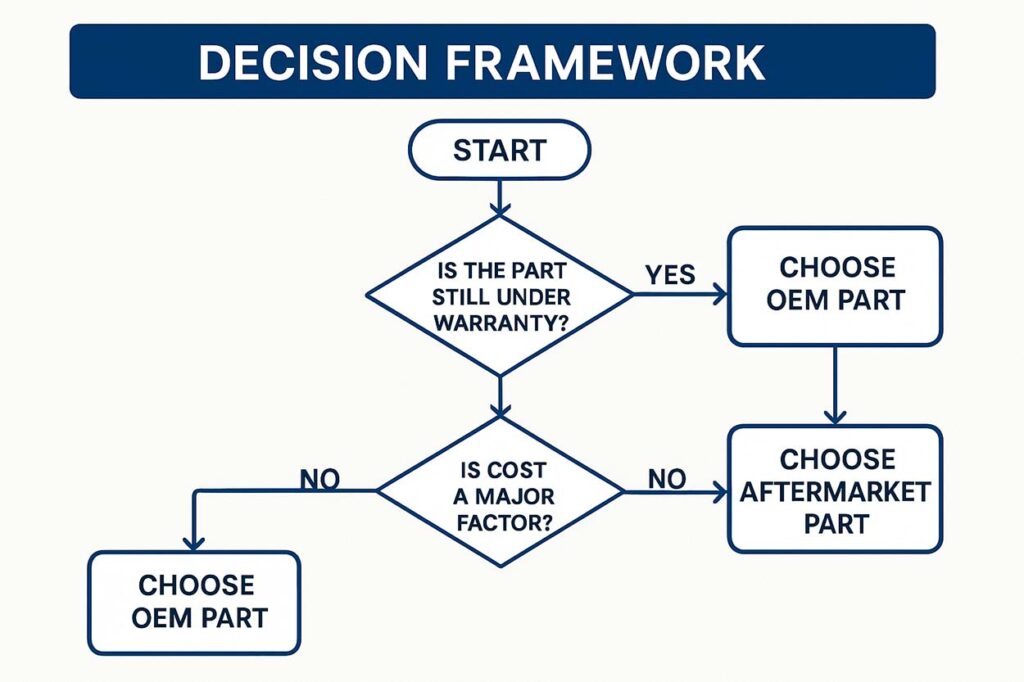

Decision Framework Implementation

Risk Assessment Matrix

High-Risk Applications (OEM Recommended): – Safety-critical systems – Regulatory compliance requirements – Mission-critical operations – Limited maintenance windows

Medium-Risk Applications (Premium Aftermarket Viable): – Important but non-critical systems – Predictable maintenance schedules – Qualified aftermarket suppliers available – Cost optimization priorities

Low-Risk Applications (Standard Aftermarket Acceptable): – Auxiliary equipment – Frequent replacement intervals – Non-safety related functions – High-volume requirements

Supplier Qualification Process

OEM Supplier Evaluation: 1. Manufacturer authorization verification 2. Quality system certification review 3. Supply chain reliability assessment 4. Technical support capability analysis

Aftermarket Supplier Evaluation: 1. Manufacturing facility audits 2. Quality management system verification 3. Testing and certification review 4. References and case study analysis 5. Financial stability assessment

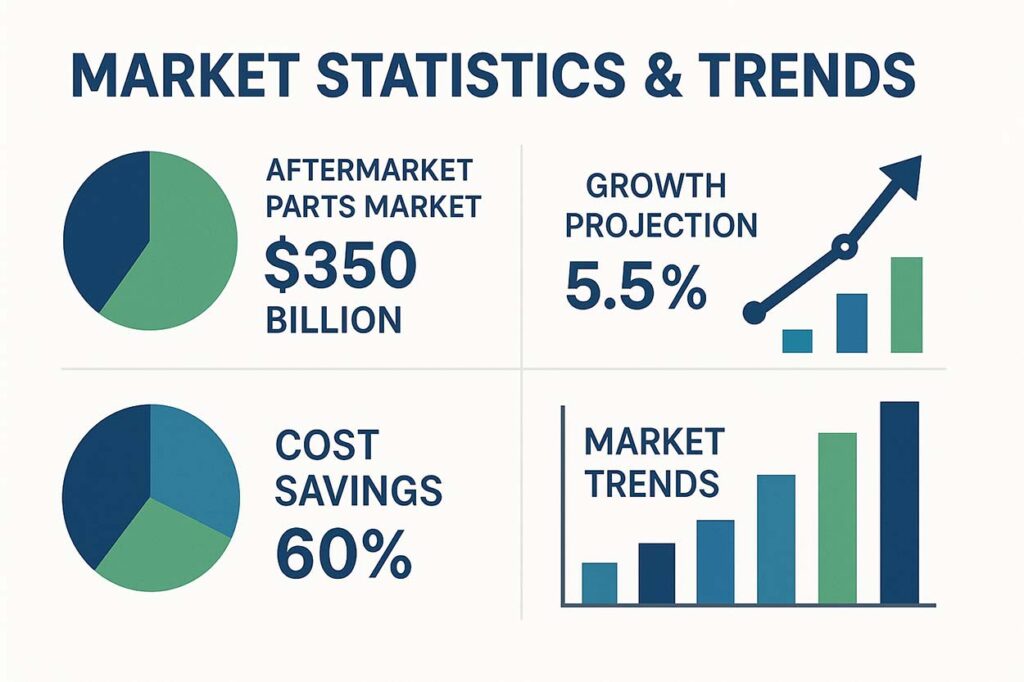

Market Trends and Statistics

Industry Growth Projections

The precision parts industry continues evolving with significant trends impacting procurement decisions:

Market Size Evolution: – 2023: $218.82 billion global aftermarket – 2033 Projection: $336.79 billion (4.42% CAGR) – Asia-Pacific leading growth at 5.1% annually – Industrial segments showing strongest adoption

Technology Integration Trends: – Digital twin compatibility requirements – IoT sensor integration capabilities – Predictive maintenance optimization – Supply chain digitalization impact

Cost Optimization Statistics

| Metric | OEM Parts | Premium Aftermarket | Standard Aftermarket |

|---|---|---|---|

| Initial Cost | Baseline (100%) | 70-85% | 50-70% |

| Failure Rate | 2-3% | 3-5% | 8-15% |

| Average Lifespan | 100% | 95-110% | 70-90% |

| Certification Compliance | 100% | 95% | 60-80% |

| Technical Support | Comprehensive | Good | Limited |

| Warranty Coverage | 12-24 months | 6-18 months | 3-12 months |

Strategic Implementation Guidelines

Phase 1: Assessment and Planning

Operational Audit: 1. Categorize all components by criticality 2. Assess current failure rates and costs 3. Evaluate supplier performance metrics 4. Review regulatory compliance requirements

Risk Tolerance Definition: – Safety-critical component identification – Acceptable downtime thresholds – Budget allocation parameters – Performance standard requirements

Phase 2: Supplier Strategy Development

Multi-tier Approach: – Tier 1: OEM for critical components – Tier 2: Premium aftermarket for important systems – Tier 3: Standard aftermarket for auxiliary equipment

Vendor Partnership Framework: – Long-term supplier agreements – Performance monitoring systems – Continuous improvement programs – Emergency response protocols

Phase 3: Implementation and Monitoring

Pilot Program Execution: – Start with non-critical applications – Monitor performance metrics closely – Document lessons learned – Scale successful strategies

Performance Tracking: – Cost reduction achievement – Quality metric maintenance – Compliance record keeping – Operational efficiency gains

Expert Recommendations

When to Choose OEM Parts

Mandatory Scenarios: – Regulatory requirements specify OEM usage – Warranty preservation critical – Safety systems and critical applications – New equipment under manufacturer support

Optimal Scenarios: – Complex integration requirements – Limited technical expertise available – High liability risk applications – Standardization priority

When Aftermarket Makes Sense

Cost Optimization Opportunities: – High-volume replacement requirements – Non-critical system applications – Mature technology with proven alternatives – Budget constraint situations

Performance Enhancement Possibilities: – Upgraded material specifications available – Improved design iterations – Enhanced performance characteristics – Obsolete OEM parts scenarios

Risk Mitigation Strategies

Supply Chain Diversification

Multi-source Strategy Benefits: – Reduced single-point-of-failure risk – Enhanced negotiating leverage – Improved availability assurance – Cost optimization opportunities

Implementation Framework: – Primary OEM supplier for critical needs – Qualified aftermarket backup suppliers – Emergency stock management protocols – Supplier performance monitoring systems

Quality Assurance Protocols

Incoming Inspection Procedures: – Dimensional verification requirements – Material composition testing – Performance validation protocols – Documentation compliance review

Ongoing Monitoring Systems: – Failure rate tracking – Performance degradation analysis – Cost impact assessment – Supplier scorecard maintenance

Technology Impact and Future Considerations

Digital Transformation Influence

Smart Manufacturing Integration: – IoT compatibility requirements – Data collection and analysis needs – Predictive maintenance capabilities – Remote monitoring system integration

Industry 4.0 Implications: – Component connectivity requirements – Software compatibility considerations – Cybersecurity compliance needs – Upgrade path planning

Emerging Technologies

Advanced Materials: – Composite material applications – Nanotechnology enhancements – Smart material integration – Sustainability considerations

Manufacturing Process Evolution: – Additive manufacturing opportunities – On-demand production capabilities – Localized supply chain options – Customization possibilities

Financial Modeling Framework

Return on Investment (ROI) Calculation

Cost Savings Analysis:Annual Savings = (OEM Cost - Aftermarket Cost) × Annual Volume ROI = (Annual Savings - Risk Costs) ÷ Implementation Investment

Risk Cost Factors: – Increased failure probability impact – Additional quality assurance costs – Potential downtime expenses – Compliance and certification costs

Budget Allocation Strategies

60/30/10 Rule: – 60% budget: Critical OEM components – 30% budget: Premium aftermarket parts – 10% budget: Standard aftermarket items

Flexible Adjustment Criteria: – Industry regulation changes – Technology evolution impact – Supplier landscape shifts – Economic condition variations

Case Studies: Real-World Applications

Aerospace Manufacturing Success

Background: Leading aircraft component manufacturer facing cost pressures while maintaining zero-defect requirements.

Strategy: Implemented tiered approach with OEM parts for flight-critical systems and certified PMA parts for auxiliary systems.

Results: – 18% total procurement cost reduction – Maintained 100% regulatory compliance – Improved supplier diversification – Enhanced delivery schedule reliability

Key Lessons: Strategic categorization and qualified supplier selection enabled significant cost savings without compromising safety standards.

Oil & Gas Platform Optimization

Background: Offshore drilling operation requiring 99.5%+ uptime with challenging logistics constraints.

Challenge: Balance cost optimization with reliability requirements in harsh environmental conditions.

Solution: Hybrid procurement strategy combining OEM critical components with premium aftermarket alternatives for support systems.

Outcomes: – 22% reduction in maintenance costs – 15% improvement in parts availability – Maintained safety performance standards – Reduced emergency procurement incidents

Manufacturing Efficiency Enhancement

Background: Precision manufacturing facility producing components for medical device industry.

Objective: Reduce operational costs while maintaining FDA compliance and quality standards.

Approach: Selective aftermarket adoption for non-product-contact components with rigorous supplier qualification.

Results: – 26% procurement cost savings – Improved supplier competition – Enhanced parts availability – Maintained regulatory compliance record

Frequently Asked Questions

Q: How do I determine if an aftermarket part meets our quality standards?

A: Implement a comprehensive supplier qualification process including: – Manufacturing facility audits – Quality management system verification (ISO 9001, AS9100, etc.) – Material composition and performance testing – Reference verification from similar applications – Pilot testing in non-critical applications

Q: What are the insurance implications of using aftermarket parts?

A: Insurance considerations include: – Liability coverage for component failures – Product liability implications – Policy compliance requirements – Documentation and traceability needs – Risk assessment and mitigation protocols

Consult with your insurance provider and legal team to understand specific policy implications.

Q: How can we maintain warranty coverage when using aftermarket parts?

A: Warranty preservation strategies: – Review original equipment warranty terms carefully – Use only certified aftermarket suppliers when possible – Maintain detailed documentation of all replacements – Consider extended warranty options for critical applications – Implement preventive maintenance protocols

Q: What’s the best approach for obsolete OEM parts?

A: Obsolescence management options: – Identify authorized aftermarket alternatives – Consider reverse engineering for critical applications – Implement last-time-buy strategies for critical spares – Evaluate equipment upgrade opportunities – Establish relationships with specialized obsolescence management suppliers

Q: How do regulatory requirements impact parts selection?

A: Regulatory compliance considerations: – Research industry-specific requirements (FAA, FDA, API, etc.) – Verify aftermarket supplier certifications – Maintain traceability documentation – Implement change control procedures – Regular compliance audits and reviews

Strategic Action Plan

Immediate Actions (Next 30 Days)

- Conduct Parts Audit

- Categorize all components by criticality

- Identify high-volume, high-cost opportunities

- Assess current supplier performance metrics

- Define Selection Criteria

- Establish risk tolerance parameters

- Create decision matrix framework

- Document approval processes

- Initial Market Research

- Identify qualified aftermarket suppliers

- Request samples for non-critical applications

- Evaluate cost saving opportunities

Short-term Goals (3-6 Months)

- Pilot Program Implementation

- Select low-risk applications for testing

- Establish performance monitoring systems

- Document results and lessons learned

- Supplier Qualification Process

- Conduct facility audits

- Verify certifications and capabilities

- Establish supply agreements

- Cost-Benefit Analysis

- Track actual vs. projected savings

- Monitor quality performance metrics

- Assess implementation challenges

Long-term Objectives (6-12 Months)

- Full Strategy Implementation

- Scale successful pilot programs

- Implement comprehensive supplier management

- Optimize inventory management systems

- Continuous Improvement

- Regular supplier performance reviews

- Market trend monitoring and adaptation

- Technology integration planning

- Strategic Partnership Development

- Long-term supplier agreements

- Collaborative improvement programs

- Innovation partnership opportunities

Conclusion

The choice between OEM and aftermarket parts isn’t simply about cost—it’s about optimizing value across performance, reliability, compliance, and total cost of ownership. Successful organizations recognize that a strategic, risk-based approach to parts procurement can deliver significant competitive advantages while maintaining operational excellence.

The key lies in understanding that this isn’t an either/or decision. The most effective strategies combine the reliability of OEM parts for critical applications with the cost advantages of qualified aftermarket alternatives for appropriate use cases.

As the global aftermarket continues its projected growth toward $336.79 billion by 2033, organizations that develop sophisticated procurement strategies today will be best positioned to capitalize on emerging opportunities while maintaining operational integrity.

For precision-engineered operations across aerospace, oil & gas, and manufacturing sectors, the path forward requires careful analysis, strategic planning, and ongoing optimization. The investment in developing these capabilities pays dividends in enhanced competitiveness, improved margins, and sustained operational excellence.

Ready to optimize your parts procurement strategy? The experts at ET&ED combine deep industry knowledge with proven implementation experience to help organizations navigate this critical decision. Based in Singapore and serving precision-engineered operations worldwide, we’re positioned to support your journey toward optimized operational efficiency. Contact-us now!

This comprehensive guide represents current industry best practices and market conditions as of 2024. Specific applications should be evaluated with qualified engineering and procurement professionals. For industry-specific guidance and implementation support, contact ET&ED’s precision engineering team.

Sources and References: – Grand View Research – U.S. Automotive Aftermarket Industry Report – Wikipedia – Original Equipment Manufacturer – Industrial procurement best practices from aerospace, oil & gas, and manufacturing sectors – Market analysis from leading industry research organizations